Get Ready for AY 2025-26: Key Changes in ITR-2 Filing You Must Know!

The Income Tax Department has introduced crucial updates in the ITR-2 form for AY 2025-26. These changes aim to enhance transparency and streamline compliance.

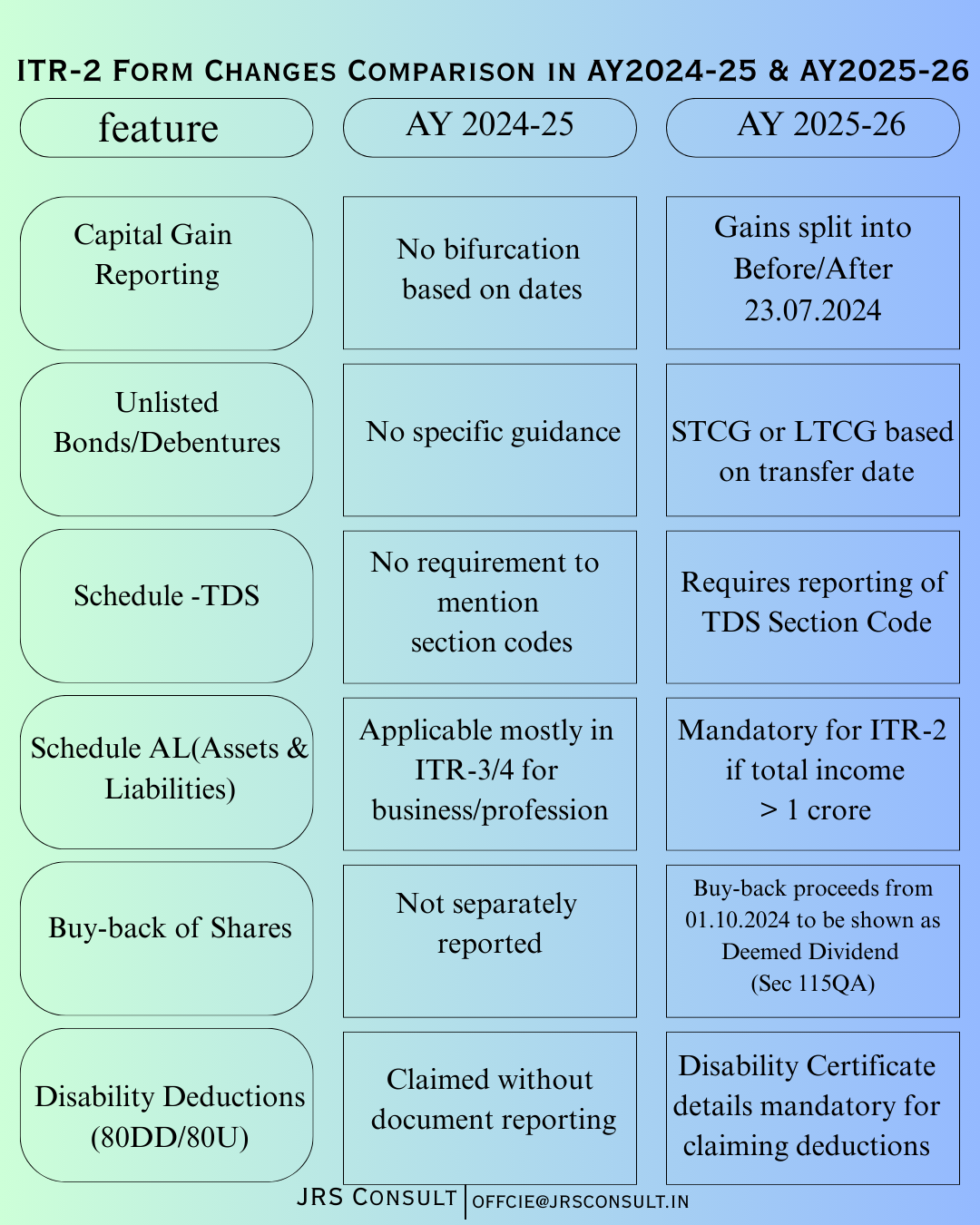

Here are some summary of major highlights:

• Capital Gains Reporting – Now split into before/after 23.07.2024

• Unlisted Bonds/Debentures – Taxed based on STCG/LTCG per transfer date

• Schedule-TDS – Mandatory disclosure of TDS Section Code

• Assets & Liabilities (Schedule AL) – Now mandatory if total income > ₹1 crore

• Buy-back of Shares – Proceeds from 01.10.2024 to be treated as Deemed Dividend (Sec 115QA)

• Disability Deductions (80DD/80U) – Disability Certificate details now mandatory

Stay informed and prepare early to ensure smooth and accurate filing!

#ITR2025 #IncomeTaxIndia #TaxUpdates #CapitalGains #Compliance