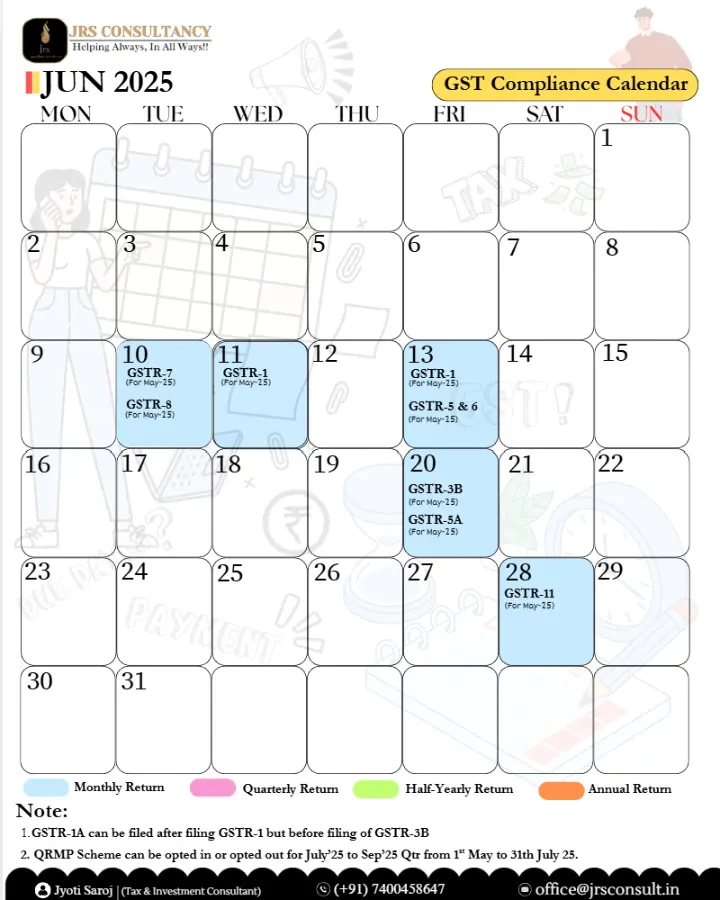

🗓️ GST Compliance Calendar – June 2025

Staying on top of your GST compliance is essential for smooth business operations and avoiding penalties. Here is a detailed calendar of key GST due dates for Jun 2025, including returns, payments, and other important deadlines.

Interesting Summary of June in India (Weather & Culture):

June in India is a month of dramatic change. It starts with intense summer heat, especially in North India, but soon welcomes the monsoon rains in the South and gradually across the country.

This seasonal shift brings relief, lush greenery, and the start of the agricultural season. Culturally, June is a time for school reopening, temple festivals in South India, and the celebration of International Yoga Day (June 21), reflecting India’s global spiritual influence. The blend of heat, rain, and rituals makes June a vibrant and transitional month.

Now, let us look at the GST due dates for June 2025. Here is the comprehensive image for June-2025 GST Compliances due date, so that you never miss the important GST Due Dates!

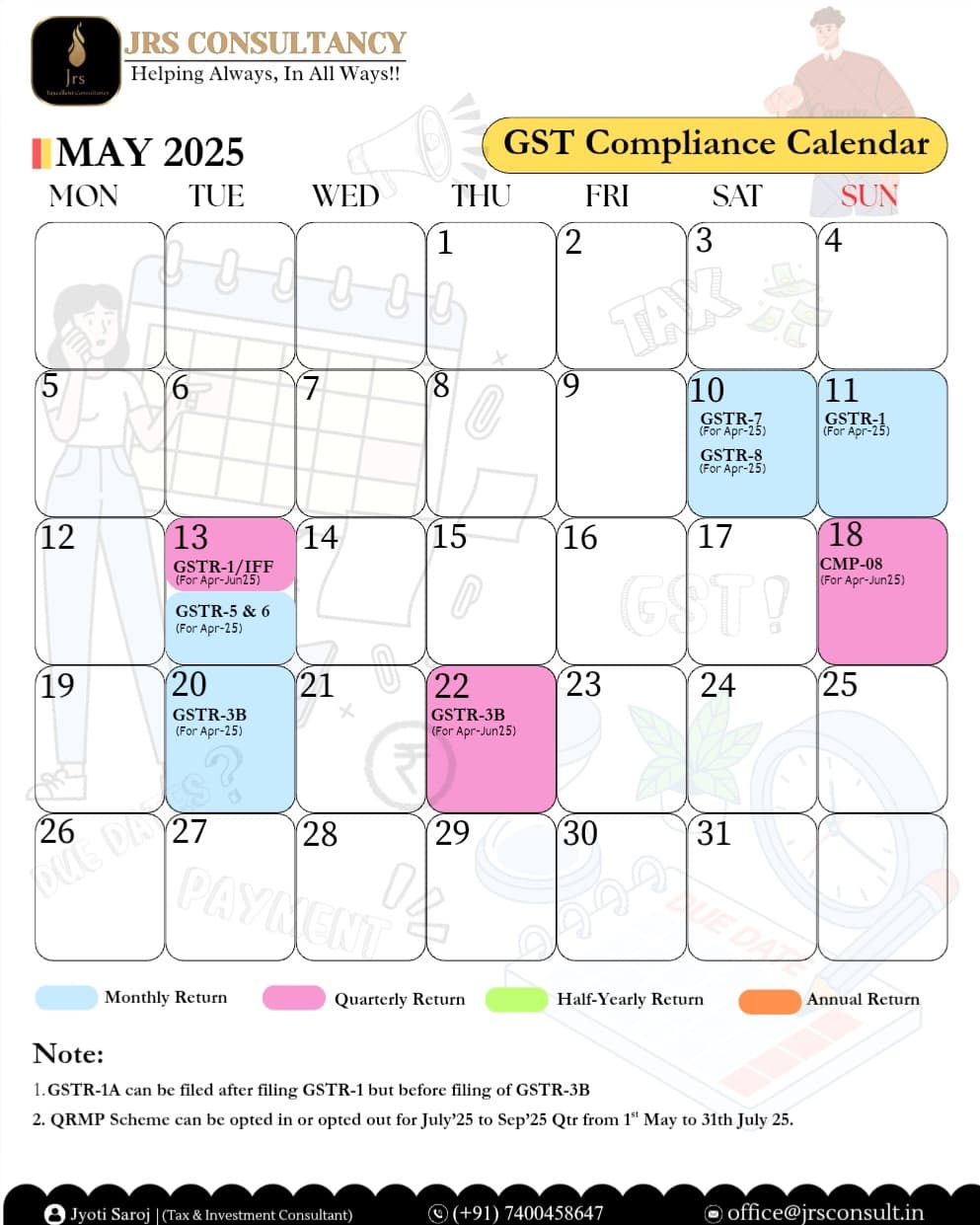

🗓️ GST Compliance Calendar – May 2025

Staying on top of your GST compliance is essential for smooth business operations and avoiding penalties. Here is a detailed calendar of key GST due dates for May 2025, including returns, payments, and other important deadlines.

| Date | Form / Compliance | Applicable To | Details |

|---|---|---|---|

| 10 May 2025 | GSTR-7 | TDS Deductors | Monthly return for GST deducted at source |

| 10 May 2025 | GSTR-8 | E-commerce Operators | Return for GST collected at source |

| 11 May 2025 | GSTR-1 (Monthly) | Turnover > ₹5 Cr or opted monthly | Outward supply details for April 2025 |

| 13 May 2025 | IFF (Invoice Furnishing Facility) | QRMP Scheme (April 2025) | For taxpayers under QRMP scheme (Optional) |

| 20 May 2025 | GSTR-3B (Monthly) | All regular monthly filers | Summary return for April 2025 |

| 22 May 2025 | GSTR-3B (Quarterly - Group 1 states)* | QRMP Filers | For Jan-Mar 2025 Quarter |

| 24 May 2025 | GSTR-3B (Quarterly - Group 2 states)* | QRMP Filers | For Jan-Mar 2025 Quarter |

| 31 May 2025 | GSTR-9 / 9C (FY 2023-24)** | Businesses with turnover > ₹2 Cr | Annual return & reconciliation (if applicable) |

* Group 1 includes Chhattisgarh, MP, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh and others.

** Subject to government notification.

🧾 Tips for GST Compliance in May

- ✔️ Reconcile invoices and credit notes with GSTR-2B.

- ✔️ Review payment of late fees and interest, if any.

- ✔️ File on time to avoid penalties and ITC mismatch issues.

- ✔️ Use GST software or a tax consultant for accurate and timely filing.

📌 Final Thoughts

With multiple deadlines in a month, it's easy to miss a due date — but even a small delay can result in penalties. Bookmark this page or set reminders for your team to ensure full GST compliance in May 2025.

If you need help managing your returns or automating your GST filings, contact us — our experts are here to help!